Recent legislation has allowed for significant capital-gains tax savings on investments in designated opportunity zones (“OZs”).

There are over 8,000 Opportunity Zones spread throughout all 50 states and U.S. territories, with the entire island of Puerto Rico being one. In general, the zones were designated by governors and located within low-to-moderate income census tracts. This program could offer considerable benefits for investors, lenders and the communities located in OZs, but the benefits do come with risk and some unknowns.

In a very basic sense, Opportunity Zone legislation reduces taxes on capital gains when the funds are properly invested in projects designed to stimulate certain neighborhoods. The vehicle to invest these funds is called an opportunity fund. Investors can establish their own fund or invest in an existing one.

The “Investment in Opportunity Act” was included in the “Tax Cuts and Job Act” passed into law in December 2017, and the program was partially implemented in February 2018. Some describe the tax incentive as a “1031 exchange on steroids,” and there are three basic benefits:

- Capital gains are deferred to 2026.

- If eligible investments were made in 2019, the initial tax liability is reduced by 15%. If made through 2021, the tax liability is reduced by 10%.

- Potentially the most lucrative benefit, if the property or business is sold after 10 years of investment, there is no capital gains tax on the appreciation, as the tax benefit is tied to the project through 2047.

The rules are many and varied. Lenders should align themselves with well-informed attorneys and Certified Public Accountants (CPAs) who can provide specific guidance to their clients. A full understanding of, and strict adherence to, the guidelines is necessary to preserve the tax advantages. By having this knowledge, the lender can be positioned as a trusted advisor and tap into a pool of potential commercial loans with favorable risk profiles.

Program basics are shown in Figure 1.

Legislation Details

Unlike 1031s, the Investment Opportunity Act allows for contrasting investments. In other words, a client can sell a business and invest in real estate, or sell stocks and invest in a business. Recent guidance by the U.S. Treasury Department also allows for projects on ground-leased properties.

To take advantage of Opportunity Zone funding, it is essential that you collaborate with experienced CPAs and attorneys that have a good understanding of the legislation. Here are just a few other things to keep in mind:

- Investments into an opportunity fund must be made within 180 days of when the capital gain was created. This does not mean all funds must be deployed at that time.

- Once a project is designated within the opportunity fund, investors have 31 months to deploy 100% of cash in the fund. During this time, 90% of the cash cannot be invested in other securities or investments.

- If a property is being acquired, new investment in the property must be greater than the property value, less the land value. This generally takes the form of expansions and renovations. For example, if a property is purchased for $1 million with land worth $500,000 and the building is worth $500,000, an investor would need to improve the property by at least $500,000, or the value of the existing structure.

- For businesses relocating or being acquired in an OZ, the value of the business must be doubled through cash investments, and sweat equity is not allowed. Clarification in the most recent Treasury statement allows cash to be spent within 31 months on Accounts Receivables, inventory, salaries and equipment.

- Traditional “sin businesses” and corresponding real estate are prohibited. As defined by the Internal Revenue Service (IRS), these include casinos, massage parlors, liquor stores, country clubs and golf courses.

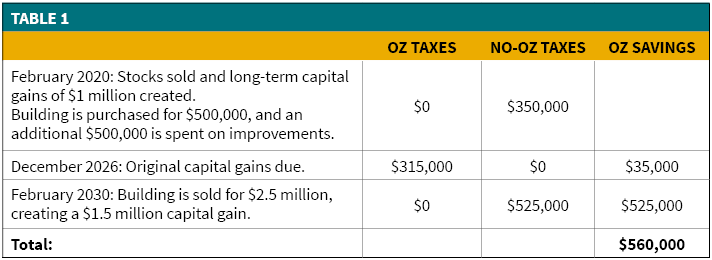

Table 1 demonstrates the significant potential tax savings of investing in Opportunity Zones. The illustration does not account for the time-value of money, as the original capital gains are deferred to 2026. Also, it assumes the taxpayer is in the 35% tax bracket. There was a large push to close OZ transactions in December 2019 to capture the full 15% reduction of capital gains basis. However, as Table 1 demonstrates, the major tax savings comes after 2026. Even when the 15% (or 10%) reduction in basis is removed, there is still significant upside. Consequently, there will be demand for OZ projects through 2026.

The Upside

As noted, this program provides for neighborhood revitalization by directing investment dollars to specific areas that might otherwise be overlooked for development projects. The legislation allowed state governments to determine appropriate zones in need of economic stimulus. As such, the investments create invaluable new jobs and expand the tax base.

The main benefit for investors is the favorable income tax implications. By injecting otherwise taxable income, investors can greatly reduce or eliminate capital gains taxes. Additionally, the underlying projects can provide a favorable source of recurring income for many years.

Criticisms and Potential Downside

While the purpose and intent of the Opportunity Zone program is to provide stimulus to communities that need it, certain aspects have come under scrutiny and criticism. Some argue that particularly designated zones are already flourishing and not in need of stimulus. One example are areas near college campuses. While the main residents (students) typically generate little or no income, the neighborhoods are often vibrant, with many thriving businesses and minimal real estate vacancies. The result is that otherwise taxable income is being generated tax-free in areas that are not in need of revitalization. Not only would this be a burden for taxpayers, but also the funds could be better used in other areas truly needing the growth incentive. For these areas, there is concern that the additional investment, with no affordable housing requirements, will result in long-term gentrification.

Furthermore, since the OZ investments are self-reported, the programs could open avenues for abuse. Additionally, unlike other tax programs such as New Markets Tax Credit and Low Income Housing Tax Credits, there is no need to report the number of jobs created or social impact. Moreover, the program generally benefits wealthier taxpayers who have capital gains, potentially leading to political backlash.

Finally, the total federal cost of the program is unknown. One reason the 10-year hold period was instituted is that the Congressional Budget Office provides tax-revenue projections for 10 years, so the full cost of the program will not be realized until year 11.

Conclusion

Overall, Opportunity Zone legislation can and should be used to stimulate local and regional economies. By directing investments to otherwise unattractive areas, the program is a powerful tool for social impact. Adherence to the rules is imperative to preserve the favorable tax benefits, so with an understanding of these rules, the savvy lender can generate a new pool of quality, commercial loans, all while benefiting the communities they serve.